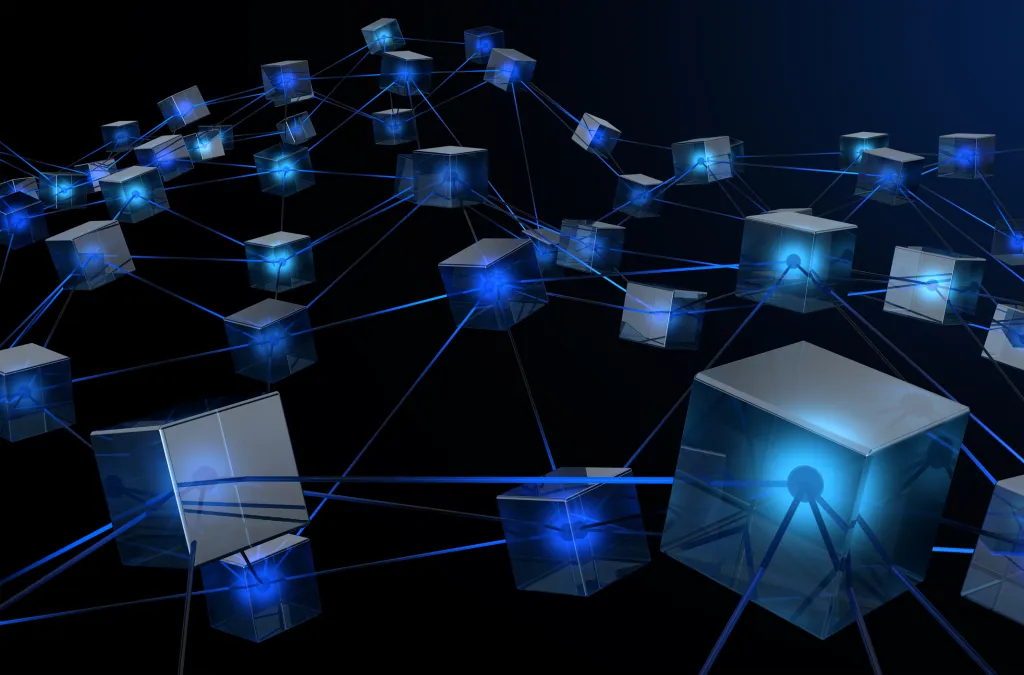

The global payments landscape is undergoing a major transformation. Traditional payment systems—often slow, expensive, and vulnerable to fraud—are being replaced by blockchain-powered payment solutions that offer unmatched speed, transparency, and security. Businesses across industries are now adopting blockchain payments to streamline transactions, reduce costs, and build customer trust.

IT Artificer delivers next-generation blockchain payment solutions that help businesses embrace decentralized finance while maintaining compliance, scalability, and performance.

Why Blockchain Payments Are the Future of Digital Transactions

Unlike conventional banking systems that rely on intermediaries, blockchain payments operate on decentralized networks, enabling peer-to-peer transactions that are faster and more reliable.

Key advantages include:

- Real-time or near-instant transactions

- Lower transaction and processing fees

- High-level security through cryptographic encryption

- Complete transparency and traceability

- Reduced risk of fraud and chargebacks

Blockchain is not just improving payments—it is redefining how value is exchanged globally.

How Blockchain Makes Payments Faster

Traditional cross-border payments can take days due to banking intermediaries and manual verification. Blockchain removes these barriers.

With blockchain payments:

- Transactions are validated automatically through distributed ledgers

- Payments are processed 24/7 without banking delays

- Cross-border transfers settle within minutes

Result: Faster cash flow and improved operational efficiency for businesses.

Lower Costs, Higher Efficiency

Blockchain significantly reduces transaction fees by eliminating intermediaries such as banks and payment processors.

Cost-saving benefits:

- No third-party processing fees

- Reduced currency conversion costs

- Lower operational and reconciliation expenses

This makes blockchain payments especially valuable for e-commerce, fintech, global enterprises, and digital platforms.

Security & Trust Built Into Blockchain

Security is a major concern in digital payments, and blockchain excels in this area.

Blockchain security features:

- End-to-end cryptographic encryption

- Immutable transaction records

- Distributed verification prevents single-point failures

- Reduced fraud and unauthorized access

IT Artificer implements enterprise-grade blockchain security protocols, ensuring safe, compliant, and tamper-proof payment systems.

Use Cases of Blockchain Payments Across Industries

- E-commerce: Faster checkout and lower payment fees

- International Trade: Instant cross-border settlements

- Fintech & Banking: Secure digital wallets and crypto payments

- Subscription Platforms: Transparent and automated billing

- Real Estate & B2B: High-value transactions with full traceability

IT Artificer’s Role in Blockchain Payment Solutions

IT Artificer helps businesses adopt blockchain payments through custom-built, scalable, and secure solutions tailored to modern digital ecosystems.

Our expertise includes:

- Blockchain Payment Gateway Development

- Crypto & Digital Wallet Integration

- Smart Contract-Based Payment Automation

- Cross-Border Blockchain Transaction Systems

- Compliance-Ready & Secure Payment Architecture

At IT Artificer, we don’t just implement blockchain—we design future-ready payment infrastructures that drive efficiency and trust.

Business Benefits of Blockchain Payments

Faster transaction settlement

Reduced payment and operational costs

Improved customer trust and transparency

Enhanced security and fraud prevention

Scalable and global-ready payment systems

The Future of Payments Is Decentralized

As digital commerce continues to expand, blockchain payments are becoming a strategic advantage rather than an innovation. Businesses that adopt blockchain early gain efficiency, reduce dependency on traditional financial systems, and stay competitive in an evolving digital economy.

IT Artificer empowers organizations to transition smoothly into blockchain-powered payments—ensuring speed, security, and scalability at every step.

Contact IT Artificer

Website: itartificer.com

Email: info@itartificer.com

Phone: 0333-9296314